Looking for a home for sale in Kansas City? There are 4 home buyer trends to watch in 2020 so you have an edge on the competition. And, there’s a lot of buyer competition for the limited homes on the market.

Kansas City Housing Market

There are lots of questions for 2020 some of which impact the housing market. Who will become the next President, will there be a recession, and will mortgage rates stay low? However, with a looming trade deal with China, optimism is growing that the predicted downturn in the economy will not happen or will not have much of an impact on real estate, especially in the KC area.

There is great optimism for home buyers with historically low-interest rates, affordable prices in this area, and amazing Kansas and Missouri down payment programs.

The demand for homes is expected to continue to surge especially with mortgage rates expected to remain below 4-percent throughout 2020. These historic lows are fueling demand.

This means you need to be strategic if you’re a buyer because there’s more competition for homes for sale in the Kansas City area. Get an experienced Kansas City Realtor ® who can help you navigate the low inventory and find the home of your dreams.

Kansas City Real Estate Market trends for buyers:

- Mortgage rates down nearly 1% year over year and expected to stay below 4% in 2020.

- You don’t need a 20% down payment on a home. There are more than a dozen programs that can help make homeownership affordable.

- Competition for entry-level homes will remain strong for several years.

- New construction is the answer to the inventory shortage, with many options below $300K.

- Owning is cheaper than renting.

Historically low-interest rates

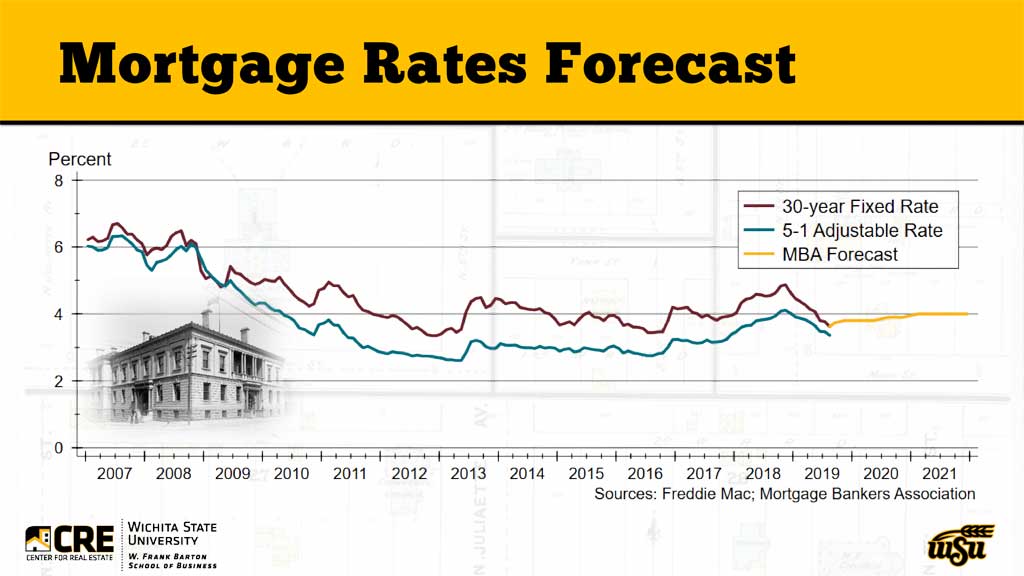

Interest rates for a mortgage are down more than 1-percent from last year which offers homeowners tremendous savings over the life of the loan. Plus, they’re expected to stay under 4-percent in 2020 which is historically low. To give you some perspective of how low they are, look at this graph from Wichita State University’s Center for Real Estate.

As a buyer, take advantage of these low rates while they last. Eventually, they’re going up. Housing experts predicted that would happen in 2019, and it didn’t. So, we know at some point they will go up.

Learn how to save thousands by mortgage shopping.

Click here to get your FREE copy!

Down payment help in Kansas City

Affordability is the theme for 2020 as home prices are up with such low inventory. If your price range is $300K and below, expect a great deal of competition.

Sign up for property alerts so you don’t miss these homes as they won’t last long! You can set up your own parameters so you only see homes you’re interested in!

Despite affordability concerns, there’s good news in the KC area. This is one of the most affordable places to buy a home in the country.

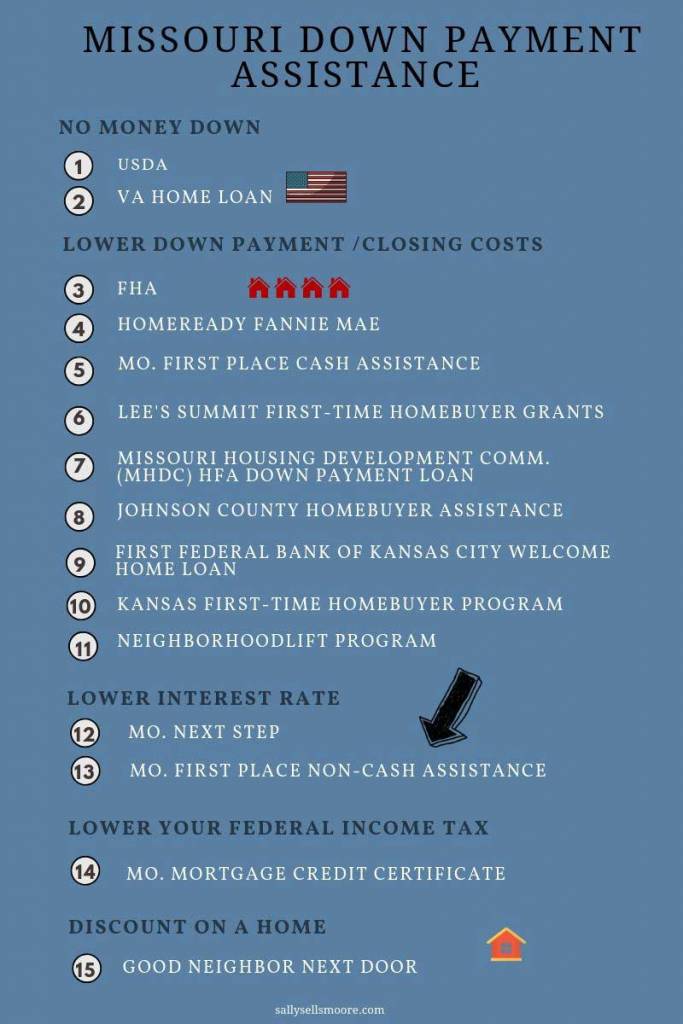

With all the national accolades for the Kansas City area, it’s a great place to settle down and purchase a home. Second, there are a number of down payment options available to first-time buyers and repeat homeowners.

For example, if you’re a qualified teacher, service member, veteran, law enforcement officer, firefighter, or an emergency technician you qualify for a $17,500 grant from NeighborhoodLIFT which is a new program in the area. This is more than the traditional down payment assistance offered through this program.

Learn more about all these down payment options in Kansas City!

In a TransUnion survey, 58-percent of buyers said they are delaying a home purchase because they don’t have enough money for a down payment. That doesn’t have to be the case in Kansas City with all these programs.

There’s a misconception about down payment options. You don’t need 20-percent, even though that’s what most people think. You can purchase a home with as little as 3-percent down.

So, make sure you take advantage of these programs. They all have different qualifying terms and loan programs. Your lender or real estate agent can help you find the best one for your financial and personal situation.

Affordable homes for sale

Competition for entry-level homes, below $300K, will remain strong for years so there’s no reason to wait. Inventory may increase slightly, but we’re not expecting big changes in the foreseeable future.

Plus, half of all mortgages in 2020 will be from Millennials (those born between 1981-1997) according to Realtor.com. Many of whom will be in the already-competitive $300K price range.

This trend will continue with an estimated 8.3 million first-time homebuyers looking for homes between 2020 and 2022. That’s more than any three-year period in the last decade, according to a report from TransUnion.

We’re making it easy to find affordable homes for sale in the Kansas City area, with our custom-home searches. You can search by city (Blue Springs, Lee’s Summit, Independence, Grain Valley) or price.

Kansas City area homes under $250K, sorted by city and price.

Kansas City area homes under $300K, sorted by city and price.

You can also do your own custom search.

New homes for sale in Kansas City

New construction is the market to watch. It offers a great opportunity for buyers who can’t find what they’re looking for on the resale market.

While costs are up here too, there are still opportunities to find homes that offer you a good value. Our team works with builders who specialize in affordable new homes, with high-quality finishes.

This new construction home for sale is $20K off list price because the previous deal fell through because the buyer lost his financing. When you hire an agent with connections to resale communities and builders in new construction, you’ll find homes for sale that fit your budget!

We also have this new construction home for sale for $219,900.

Wichita State University housing experts expect new construction to slow in Kansas. However, they’re predicting another strong year for Kansas City with a 16.4-percent increase in building permits. That’s three times higher than Manhatten, Kansas which is expected to see the most growth of any city in Kansas. When you work with an experienced real estate agent in Kansas City, you’ll find affordable new homes and deals.

The Sally Moore Real Estate team has options below $300,000 in the following neighborhoods:

Ryan Meadows – Grain Valley, MO 64029 – Mid $200’s

Sonora Valley – Blue Springs, MO 64014 – Mid to upper $200’s+

Rosewood Hills – Grain Valley, MO 64029 – Upper $200’s+

Brittany Ridge – Blue Springs, MO 64015 – Upper $200’s+

These are the homes for sale in these neighborhoods, offered exclusively by our team.

Explore all the options in all our new construction neighborhoods.

If you’re interested in homes outside these neighborhoods, we put together this list with the latest new construction home options in the KC area.

KC rental costs increasing

Rising home prices should not keep you away from the market, as rental prices are going up too! In fact, at some of their fastest rates in years.

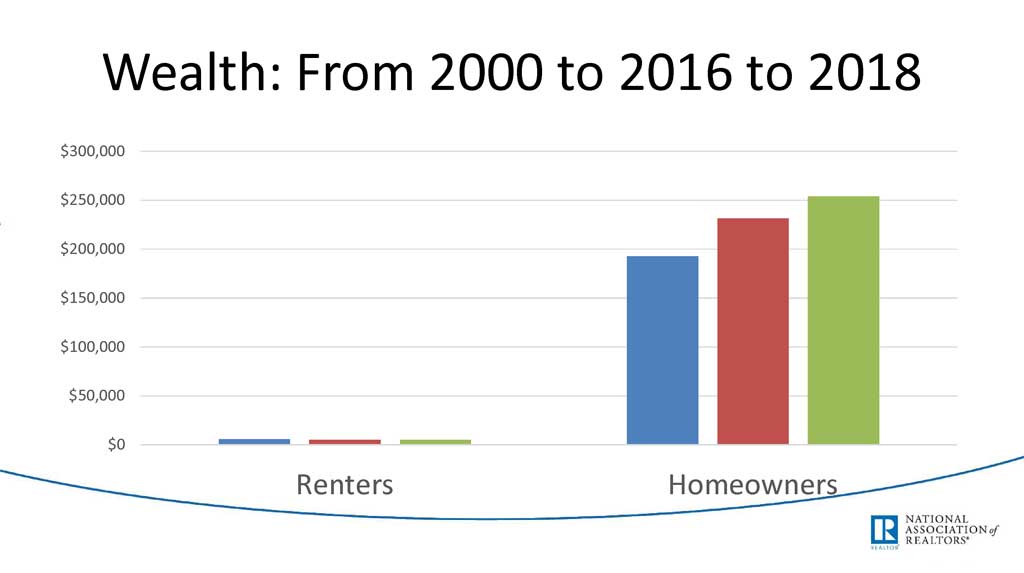

As home prices rise, homeowners are accruing wealth, without doing anything. Meanwhile, renters are giving someone else that equity with their monthly fees.

For example, in Lee’s Summit the median home value is $240,600 according to Zillow. The median home for sale is listed at $306,777. Meanwhile, rent in Lee’s Summit is $1425, which is the highest since 2011. You could pay less than the going rent if you bought a home for $306,777 with 20-percent down, and paid average property taxes and homeowners insurance.

Depending on taxes, homeowner’s insurance, and down payment percentages your mortgage may be higher or lower. Even if it was the same as rent, you’d still be in a better financial scenario than renting because with a home you gain equity.

High housing and apartment rents are not isolated to Lee’s Summit. In Grain Valley, the median price of homes listed for sale is $240,000. The median rent is $1250 according to Zillow. Again, you could get a mortgage for that price or less, depending on how much you put down.

Homeowners are accruing wealth, through their home whereas renters are losing money. During a presentation in Kansas City, Lawrence Yun with the National Association of Realtors demonstrated the wealth difference between homeowners and renters.

Buying a home in 2020

With prices up, homebuyers may worry they don’t have enough money. But, actually, Kansas City’s weekly earnings are the highest since 2007. The average person takes home around $1000 a week, according to the National Association of Realtors ® Chief Economist and Senior Vice President of Research, Lawrence Yun. Find out how much money you need to make to afford a home in the area.

That combined with job growth and low unemployment in the KC area will allow for steady real estate growth in 2020, despite the higher home values.

As a buyer, take advantage of down payment programs and low-interest rates to find a home in 2020!

What’s your biggest challenge as a buyer?

3751 NE Ralph Powell Road

3751 NE Ralph Powell Road